Build A Tips About What Is The 12 Digit Reference Number

Sell A Private Number Plate Reg

Unlocking the Mystery of the 12-Digit Reference Number

1. What Exactly Is This Number, Anyway?

Ever stared at a bill, a statement, or even a random piece of mail and noticed a string of twelve digits staring back at you? That, my friend, is likely a 12-digit reference number. But what is it, and why should you care? Think of it as a unique identifier, like a fingerprint for a specific transaction, account, or document. It helps organizations quickly and accurately locate your information within their vast databases.

Imagine a massive library with millions of books. Without a proper cataloging system, finding a specific book would be a nightmare, right? A 12-digit reference number does the same job, acting as the catalog entry that points directly to your information. It ensures your payment gets credited to the right account, your order gets processed correctly, and your inquiry reaches the appropriate department.

So, while it might seem like just a random assortment of numbers, this little sequence is actually a powerful tool for efficiency and accuracy. Its the unsung hero of modern administration, quietly working behind the scenes to keep things running smoothly. Next time you see one, give it a nod of appreciation. It's earned it!

The importance of these numbers shouldn't be overlooked. Errors happen, but having a precise reference number minimizes the likelihood of mix-ups, which is a win for everyone involved. Misidentifying a payment because of a misplaced digit can cause headaches for you and the company. This number significantly reduces that risk, leading to faster resolution times should any problems arise.

How To Find The UTR Details? Widget

Deciphering the Code

2. From Banking to Bills

These nifty numbers pop up in a surprising number of places. One of the most common is banking. Banks use them to track transactions, link payments to specific accounts, and identify transfers. Think of it as a digital signature for your money movements. Without it, chaos would reign supreme, and your funds might end up in the wrong place. No one wants that!

Beyond banking, utility companies are also big fans of the 12-digit reference number. They use it to identify your account, track your usage, and ensure your bills are accurate. When you contact them with a query, providing this number allows them to pull up your information instantly, saving you (and them) valuable time. It's the express lane to customer service bliss.

E-commerce platforms use them too! Think about the confirmation email you receive after placing an order. That string of numbers and letters? Often contains a 12-digit reference number (or a similar alphanumeric code) allowing them to track your order from warehouse to doorstep. It's your secret code to monitoring the progress of your long-awaited package.

Even government agencies and healthcare providers utilize these identifiers for similar purposes: tracking claims, managing records, and ensuring patient information is accurate and readily available. Its a critical component in maintaining the integrity and efficiency of large, complex systems. It's a key to efficiency, accuracy, and the avoidance of major headaches.

Where to Find Your Elusive Number

3. The Great Hunt

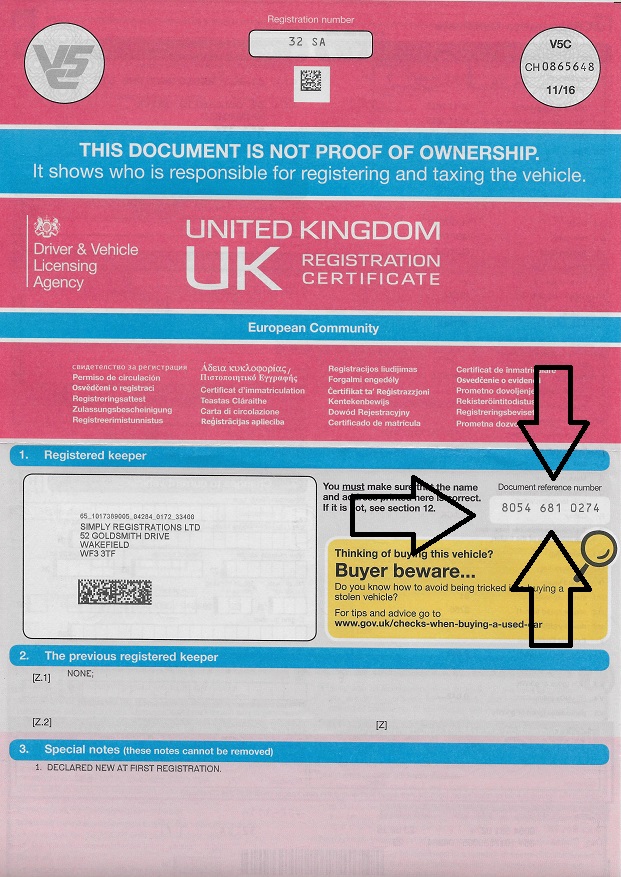

So, where do you actually find this magic number? The good news is, its usually prominently displayed on any document or communication related to the transaction or account in question. Check your bank statements, utility bills, order confirmations, and any correspondence from relevant organizations. Its generally near your name, address, or account details.

Look for headings like "Reference Number," "Account Number," "Transaction ID," or similar terms. The exact label may vary depending on the organization, but the context should give you a good clue. If you're still struggling to locate it, don't be afraid to contact the company directly. Their customer service representatives can guide you to the right spot.

Nowadays, many companies also display these numbers online, within your account dashboard or transaction history. Log into your online banking portal, utility account, or e-commerce platform and navigate to the relevant section. You should find the 12-digit reference number clearly displayed, often alongside other important information.

And a pro tip: keep a record of your important reference numbers in a safe and accessible place. Whether it's a password-protected document on your computer or a securely stored physical notebook, having these numbers readily available can save you a lot of time and frustration in the long run. Consider this your future-self a great favor.

How To Get Your 10digit Reference Number New ZAMCELCO

Why Accuracy Matters

4. A Single Digit Can Make All the Difference

Pay close attention when entering or providing your 12-digit reference number, because accuracy is paramount. A single transposed digit can lead to delays, errors, and potential financial headaches. Imagine accidentally entering the wrong account number when making a payment — your money could end up in someone else's account! Not fun, right?

Always double-check the number before submitting any information, whether it's online or over the phone. Take your time and compare it carefully to the original source document. It's a small step that can prevent a world of trouble down the road. Think of it as a mini-audit of your own financial transactions.

If you're providing the number over the phone, speak clearly and slowly, especially when reciting similar-sounding numbers like "three" and "free." Avoid background noise that could interfere with the other person's ability to hear you correctly. If possible, spell out the number letter by letter to be extra cautious.

If you suspect you've made a mistake, contact the relevant organization immediately. The sooner you catch the error, the easier it will be to rectify. Provide them with the correct number and explain the situation. Most companies are understanding and will work with you to resolve the issue quickly and efficiently.

The Future of Reference Numbers

5. Evolving Technology and the Ever-Present Identifier

While the 12-digit reference number has been a staple of administrative systems for years, it's likely to evolve alongside technological advancements. We might see more sophisticated systems that incorporate biometric data or blockchain technology to enhance security and accuracy. The core principle, however, will remain the same: to uniquely identify transactions and accounts.

The rise of digital wallets and mobile payment platforms could also influence the way reference numbers are used. We might see more seamless integration between these platforms and existing systems, making it even easier to track and manage transactions. The goal is to create a more streamlined and user-friendly experience.

Artificial intelligence (AI) could also play a role in the future of reference numbers. AI algorithms could be used to automatically detect and correct errors, preventing costly mistakes. They could also be used to personalize the way reference numbers are displayed and managed, making them more intuitive and accessible.

Ultimately, the 12-digit reference number, or its future equivalent, will continue to play a vital role in ensuring the smooth functioning of modern commerce and administration. Its a testament to the power of organization and the importance of accurate identification in a complex world. So, embrace the numbers, learn to love them, and appreciate the crucial role they play in our daily lives.

FAQ

6. Q

A: It depends on the situation, but generally, it can cause delays in processing your payment or request. Your payment might be credited to the wrong account, your order could be misdirected, or your inquiry might not reach the correct department. Contact the organization immediately to rectify the error.

7. Q

A: Not necessarily. An account number identifies your overall account with an organization, while a 12-digit reference number typically refers to a specific transaction or document related to that account. They're related but serve different purposes. Think of the account number as your home address, and the reference number as the specific apartment number within that building.

8. Q

A: While the number itself doesn't contain sensitive information like your password or credit card details, it's still important to protect it. Avoid sharing it with untrusted sources and be cautious when entering it online. Always ensure you're on a secure website with "https" in the address bar before submitting any information.